Top 10 Money Lessons Schools Don't Teach

Discover the essential money lessons that schools overlook, including budgeting, saving, investing, and passive income strategies. Learn how to make smarter financial decisions, start side hustles, and build a secure financial future with practical tips for financial literacy.

8/31/20253 min read

The Importance of Financial Education

Money touches every part of our lives—yet schools rarely teach us how to manage it. Imagine graduating knowing how to budget, save, invest, and build wealth instead of learning the hard way later. From mastering credit to planning for retirement, these are the money lessons that could change your future—and it’s time to uncover the top 10 schools should be teaching but don’t.

1. How to Budget Money

Budgeting is a fundamental skill that enables individuals to track their income and expenses. Schools should teach students how to create realistic budgets that reflect their financial situation. This involves understanding the importance of distinguishing between needs and wants and prioritizing their spending accordingly. A solid budgeting plan can serve as the roadmap for achieving financial goals.

2. Saving Habits

Establishing good saving habits early is crucial for financial security. Schools should encourage students to set aside a portion of their income regularly, instilling the habit of saving for future needs and emergencies. The concept of compound interest can also be discussed to illustrate how savings can grow over time, motivating students to start saving sooner rather than later.

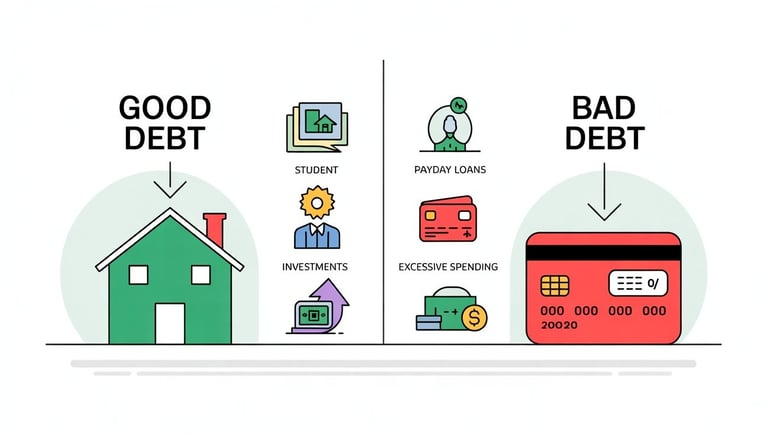

3. Understanding Credit and Debt

Many individuals enter adulthood without a clear understanding of credit and debt management. Schools must teach students the implications of borrowing money, how to build and maintain a good credit score, and the importance of managing debt responsibly. This knowledge will equip students to make informed decisions regarding loans and credit cards, avoiding unnecessary financial pitfalls.

Want to learn how to manage money wisely and avoid debt traps? CLICK HERE!

4. Basics of Investing

Investing introduces students to the potential for wealth accumulation. Schools have an opportunity to demystify investing by explaining key concepts such as stocks, bonds, mutual funds, and real estate. Through practical examples and simulations, students can learn how to navigate the investment landscape and understand the associated risks and rewards.

5. Taxes and How They Work

Understanding taxes is an essential aspect of financial literacy. Schools should cover the basics of how income taxes function, including tax brackets, deductions, and credits. This knowledge will empower students to make informed decisions about their earnings, ensure compliance with tax laws, and avoid last-minute financial stress during tax season.

6. Building Multiple Income Streams

In today’s economic climate, relying solely on a single income source can be risky. Educators should teach students about the benefits of diversifying income through side hustles, investments, or entrepreneurial efforts. Encouraging an entrepreneurial mindset can inspire innovation and help students explore their passions while generating additional income.

Ready to start building more income streams and grow your wealth faster? CLICK HERE!

7. Entrepreneurship Skills

Entrepreneurship is a vital skill that fosters creativity, resilience, and critical thinking. Schools should introduce students to the fundamentals of starting and running a business. By providing practical assignments and case studies, students can learn about market research, business planning, and budgeting, equipping them with the knowledge to succeed in their ventures.

8. Importance of Emergency Funds

An emergency fund acts as a financial safety net in times of unforeseen circumstances. Schools need to stress the importance of having at least three to six months’ worth of expenses saved. This fund can help alleviate stress during emergencies such as job loss or medical expenses, providing security and peace of mind.

9. Retirement Planning

Retirement may seem a distant concern for many young students, but it is vital to begin planning early. Schools should educate students about different retirement accounts, such as 401(k)s and IRAs, and the significance of compound growth over time. The earlier one starts saving for retirement, the more financially secure their future will be.

10. Smart Spending and Avoiding Lifestyle Inflation

With increased income often comes the temptation of lifestyle inflation. Schools should teach the importance of smart spending habits, encouraging students to prioritize their values over material possessions. Understanding the difference between necessary upgrades and unnecessary expenses is key to living within one’s means and securing financial stability.

Conclusion: A Motivational Takeaway

Financial literacy is an essential component of personal development and success in life. By integrating these ten vital money lessons into school curricula, we can cultivate financially responsible individuals who are well-prepared to face the challenges of adulthood. Parents, educators, and communities must collaborate to advocate for better financial education for students, ensuring they possess the necessary tools to flourish in the world of finance.

Take control of your financial future today—your wealth journey starts here. CLICK HERE!

Inspiration

Empowering your journey to financial freedom.

Contact us

Explore

contact@thirst4success.com

© 2025. All rights reserved.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as professional, financial, investment, or legal advice. You should consult with a qualified professional before making any decisions based on this information. We make no guarantees about the accuracy, completeness, or suitability of this content for your particular situation. Use of this information is at your own risk.